No rate cut please

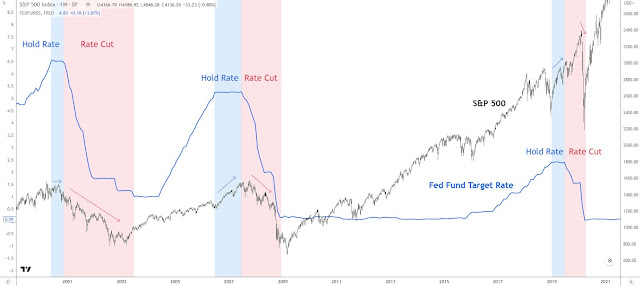

In light of the US regional bank run situation, numerous voices across social media and mainstream media are advocating for a rate cut. However, as market participants, we believe that it would be more beneficial to see US Federal Reserve to hold steady on the current interest rates. This stance signifies that the economy possesses the strength to endure current high rates.

If the Federal Reserve were to initiate a rate cut, it would signal an expectation of an impending economic contraction. Therefore, from an investor's standpoint, a pause in interest rates is preferred.

Over the weekend, we did not identify any tactical trades of interest, but we will continue to keep a close eye on the market for potential opportunities.

Headlines for Week Ahead:

US CPI & PPI

China Trade data

China CPI

US Earnings (Paypal, Walt Disney)

SG Earnings (OCBC, Capland Invest, AEM, Seatrium)

Blog disclaimers apply

In light of the US regional bank run situation, numerous voices across social media and mainstream media are advocating for a rate cut. However, as market participants, we believe that it would be more beneficial to see US Federal Reserve to hold steady on the current interest rates. This stance signifies that the economy possesses the strength to endure current high rates.

If the Federal Reserve were to initiate a rate cut, it would signal an expectation of an impending economic contraction. Therefore, from an investor's standpoint, a pause in interest rates is preferred.

Over the weekend, we did not identify any tactical trades of interest, but we will continue to keep a close eye on the market for potential opportunities.

Headlines for Week Ahead:

US CPI & PPI

China Trade data

China CPI

US Earnings (Paypal, Walt Disney)

SG Earnings (OCBC, Capland Invest, AEM, Seatrium)

Blog disclaimers apply