Thoughts on Week Ahead:

Week 13 Nov 2023

Expecting China Internet Companies Earnings to trigger China stock market directional move

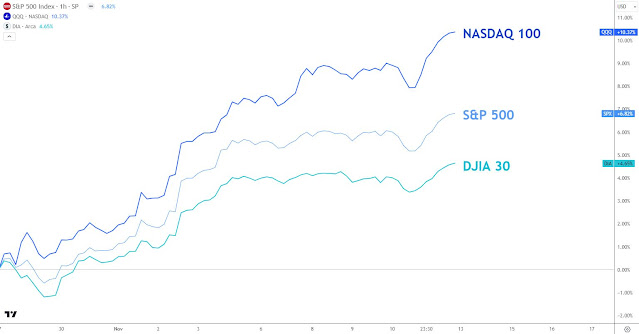

US stocks traded within a narrow trading range for the majority of the week, but concluded the week with a strong close, +1.56% on Friday. From a technical perspective, the S&P 500 has surpassed 4,400 key resistance level, leading us to anticipate a potential move towards 4,500, provided that 4,350 support remains intact.

Investors and traders will be closely monitoring the earnings reports of Chinese internet companies this week. We anticipate a directional shift following these earnings, as the reports are expected to provide insights into the recovery and growth of the Chinese consumer market. Additionally, investors are also keeping an eye on the US Oct CPI report for any unexpected developments.

Gold and oil prices experienced declines, influenced by a potential pause of tensions in the Middle East. Key support level for gold will be at US$1,900/oz.

Looking ahead to the upcoming week, preference remains for long trades, but cautious on any indications of increased supply.

Headlines for Week Ahead:

Corp Earnings (Tencent, Alibaba, JD.com, Walmart, Home Depot, Target)

US Oct CPI, Retail Sales

China Oct Econ Data

Xi-Biden Sidelines meeting at APEC

SG Oct NODX

Disclaimers apply.

%20Brandon%20Leu%20Market%20Technician.JPG)